Discover planned giving

The “Fonds éternel” committee of the Saint-Jérôme Regional Hospital Foundation is pleased to unveil the creation of the brand new Eternal Fund. The objective of this fund is to keep donation amounts constant over time, thus allowing the Foundation to invest in different projects thanks to the interest generated.

Contributing to the Eternal Fund allows you to support the Foundation and reflects your commitment to the society of today and tomorrow, even after your death. Planned giving is not only reserved for very wealthy people, it is a gesture accessible to everyone wishing to support a cause that is close to their heart.

Legacy giving

A legacy gift remains one of the simplest and most accessible ways to plan a gift. It can be achieved in the following ways:

- Specific bequest (a specific amount or a specific asset)

- Residual bequest (totality or percentage of what remains after payment of debts and special legacies)

- Designation as a subsidiary beneficiary in the event of the death of the first beneficiary

- Universal bequest (the totality of property, sometimes divided between several beneficiaries)

- Designation as beneficiary of a retirement savings plan or pension fund

- Simultaneous death clause if all the beneficiaries die at the same time

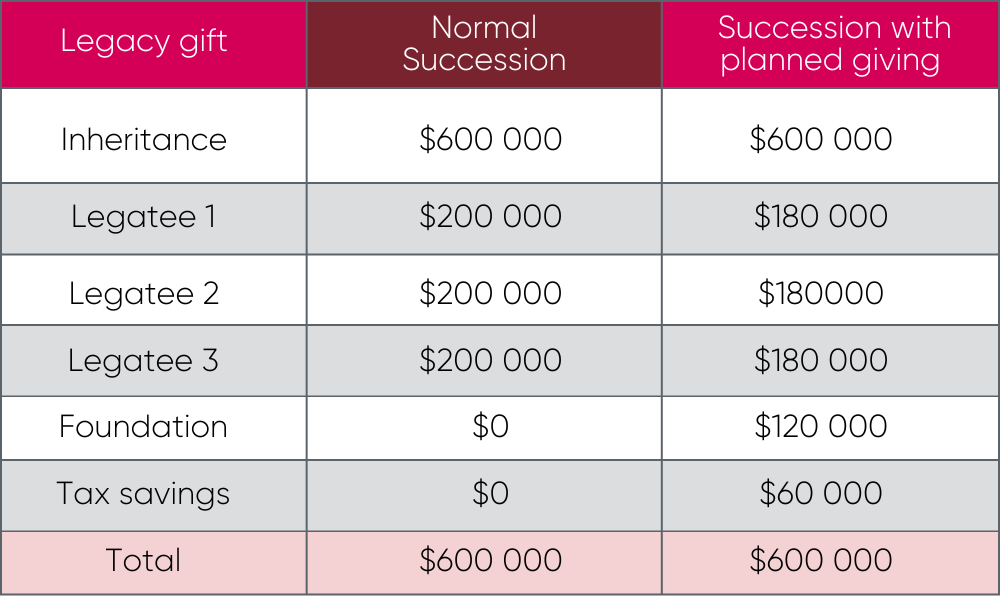

Case study

Claire – 72 years old – retired civil servant – 2 children – inheritance of $600,000

Claire is considering making a planned gift in her will. Above all, she does not want to put her children aside. Here are the 2 scenarios considered.

By donating $120,000 to the Foundation, Claire’s estate benefits from a tax saving of $60,000, which artificially inflates the estate assets.

In the end, the $120,000 donation will only have really cost $60,000.

To find out a little more, without any obligation on your part: raphaelle.prevost@fondationhrsj.com

Life insurance policy

The choice of donation terms in the form of life insurance will depend on your objectives, your age and your family situation. This could be:

- Transfer of an existing policy

- Buying a new policy

- Designation of a charity as beneficiary

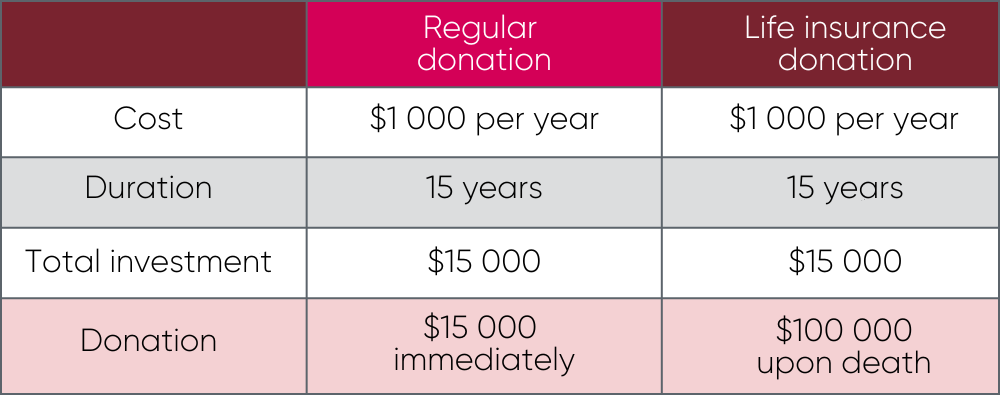

Case study

Denis – 56 years old – mechanic – 3 children – budget of $15,000

Denis is being monitored for his medical condition and he is very grateful for the care and services. As it has some flexibility monetary, he wishes to make a donation. Here are the 2 scenarios considered.

The same investment will be 6 times more generous if made through life insurance than through a donation

direct, for the same initial investment!

To find out a little more, without obligation on your part: raphaelle.prevost@fondationhrsj.com

Eligible securities donations

Donating publicly traded stocks, bonds, mutual funds and other similar securities is one of the most tax-efficient ways to make a large gift to a charitable organization. charity. It is more advantageous to transfer securities directly to an organization than to donate the proceeds from their sale.

This form of donation is suitable for those who wish to make a large donation without drawing on their own cash flow. For more information, read the article published in the special section of the Infos Laurentides newspaper entitled Do you know what the real cost of your donation is?

Ask your financial advisor

If you are considering making a planned gift, it is strongly recommended that you consult your financial advisor to choose the most appropriate asset or amount to bequeath based on your financial situation.

To find out a little more, without obligation on your part: raphaelle.prevost@fondationhrsj.com

A word from the president

As a woman in business for 25 years, I know how valuable financial planning is to ensure the sound management of a business’s activities. In my opinion, the same is true of personal finances: you must balance your budget and your investments to maximize the return on your investments and minimize the tax payable.

Planned giving is a great way to realize your philanthropic ambitions and make a difference in your community, even after your death. Whether you choose a testamentary gift, a gift through life insurance, a gift of securities, eligible securities or publicly traded shares, offering a planned gift can offer several attractive tax advantages for you or your heirs. .

I hope that you will find here the information you need to make you want to get involved in this cause that is so dear to me, namely the well-being and health of all Laurentians.

Good thinking and thank you in advance for your generosity!

Mme Suzanne Léger,

President of the Foundation’s director board

Why donate?

Our mission is to transform donations into concrete projects for the benefit of the people being treated here!

Each donation is managed diligently and with the greatest respect in order to transform it into a concrete project. Our mission is to support the hospital center, the CHSLDs, the CLSCs as well as other service centers concentrated in the territory of greater Saint-Jérôme. Our current priority is to improve the equipment in order to modernize our hospital and be able to offer a complete service.

Saint-Jérôme, health center of the Laurentides

There are many projects and new needs are constantly being added to the already full lists. The objective of the Saint-Jérôme Regional Hospital Foundation remains to invest $1 million annually in projects. Did you know that the Regional Hospital is THE medical center of the Laurentides? There are more than 202 specialists there and its emergency department constitutes a secondary trauma center. Supporting your regional hospital means providing high-tech medicine.

Would you like to chat?

Do not hesitate to contact us to support you in your reflection. We will be happy to work together with your personal advisors (tax specialist, notary, accountant, financial planner) to establish a strategy adapted to your ambitions and your situation.

Raphaëlle Prévost

Executive Director

raphaelle.prevost@fondationhrsj.com

450 431-8484, # 5

Members of the comitee

Audrey-Ann Danis

Vice-Présidente

Gestion Financière Danis

Émilie Dazé

Notaire

Émilie Dazé Notaire

Pierre-Michel Gauthier

Retraité

Banque Nationale

Paméla Ghlaeb Poitras

Propriétaire

Café La Petite Voisine

François Héroux

Directeur

Caisse Desjardins

Jonathan Léveillé

Président

Openmind Technologies

Martin McCan

Conseiller en sécurité financière,

assurances et rentes collectives

Éric Piché

Directeur

Groupe Finaction

Érika Roy

Co-propriétaire

Gisèle Produits de Beauté